Pages

990150_Page_01

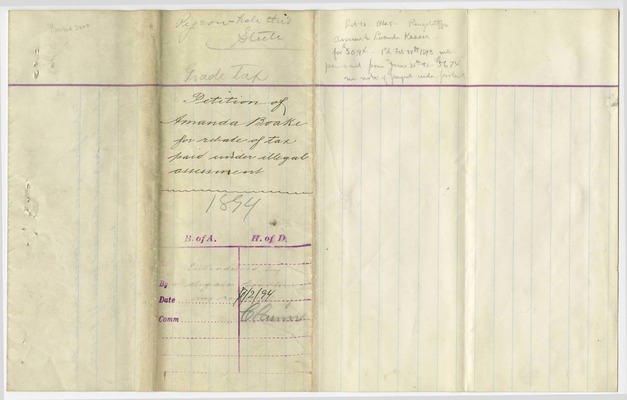

Pigeon-hole this Steete Grade Tax Petition of Amanda Boake for rebate of tax paid under illegal assessment 1894

B.of A. H.of D. Introduced by By Delegate Goodwin Date by re[?] 6/2/94 Comm Claim

Lot 12 Bk 5 Raugstorff Assessment Lucinda Kesser for $50.94 from June 25th92 $56.74 no note of payment undr protest

990150_Page_02

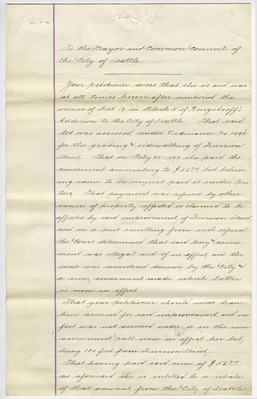

To the Mayor and the Common Council of the City of Seattle Your petitioner avers that she is and was at all times hereinafter mentioned the owner of Lot 12 in block 5 of Rengstorff's Addition to the City of Seattle. That said lot was assessed under Ordinance No 1495 for the grading and sidewalking of Division Street, That on Feby 27, 1893 she paid the assessment amounting to $56.74 but beliving same to be unjust paid it under protest. That payment was referred by other owners of property affected or claimed to be affected by said improvement of Division Street and in a suit resulting from such refusal the Court determined that said levy and assessment was illegal and of no effect and the same was considered decisive by the City and a new assessment made which latter is now in effect. That your petitioner should never have been assessed for said improvement and in fact was not assessed under or on the new assessment roll now in effect her lot being 180 feet from Division Street. That having paid said sum of $56.74 as aforesaid she is entitled to a rebate of that amount from the City of Seattle

990150_Page_03

Wherefore your petitioner prays that she be repaid the said sum of $56.74 Amanda Boake Petitioner

990150_Page_04

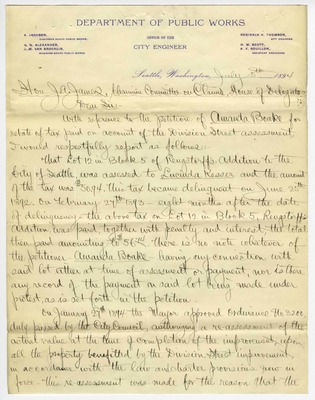

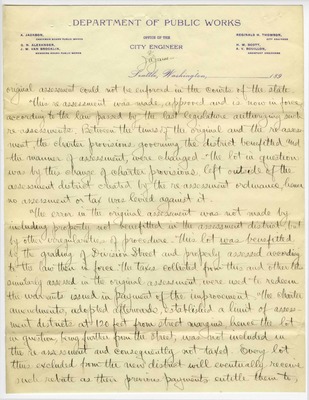

Department of Public Works Office of the City Engineer Reginald H Thompson, City Engineer H W Scott, A V Bouillon, Assistant Engineers A Jackson, Chairman Board Public Works G N Alexander, J W Van Brocklin, Members board Public Works Seattle, Washington, July 5th, 1894 Hon. J A James, Chairman Committee of Claims, House of Delagates Dear Sir, With reference to the petition of Amanda Boake for rebate of tax paid on account of the Division Street Assessment I would respectfully report as follows:That Lot 12 in Block 5 of Renstorff's Addition to the City of Seattle was assessed to Lucinda Kesser and the amount of the tax was $50.94. This tax became delinquent on June 25th 1892. On February 27th 1893 eight months after the date of delinquency, the above tax on Lot 12 in Block 5 Renstorff's Addition was paid together with penalty and interest, the total then paid amounting to $56.74. There is no note whatever of the petitioner Amanda Boake having any connection with said lot either at time of assessment of payment nor is there any record of the payment on said lot being made under protest as is set forth in the petition. On January 27th 1894 the Mayor approved Ordinance No 3200 duly passed by the City council authorizing a re-assessment of the actual value at the time of completion of the improvement upon all the property benefitted by the Division Street Improvement in accordance with the law and charter provisions now in force. this re-assessment was made for the reason that the

990150_Page_05

Department of Public Works Office of the City Engineer Reginald H Thompson, City Engineer H W Scott, A V Bouillon, Assistant Engineers A Jackson, Chairman Board Public Works G N Alexander, J W Van Brocklin, Members board Public Works 2 J A James Seattle, Washington, original assessment could not be enforced in the courts of the state This re-assessment was made, approved and is now in force, according to the law passed by the last legislature authorizing such re-assessments. Between the times of the original and the re-assessment, the charter provisions governing the district benefitted and the manner of assessment, were changed- the lot in question was by this change of charter provisions left outside of the assessment district created by the re-assessment ordinance, hence no assessment or tax was levied against it. The error in the original assessment was not made by including property not benefitted in the assessment district but by other irregularities of procedure. The lot was benefitted by the grading of Division Street and properly assessed according to the law then in force. The taxes collected from this and other lots similarly assessed on the original assessment were used to redeem the warrants issued in payment of the improvement. The charter amendments adopted afterwards established a limit of assess-ment districts at 120 feet from street margins hence the lot in question being further from the street was not included in the re-assessment and consequently not taxed. Every lot thence excluded from the new district will eventually receive such rebate as their previous payments entitle them to,