Pages

1

181 Apr 11 1890 G M Guye against the Washington St Sts Grade Ass't No 369 Finance & Atty

2

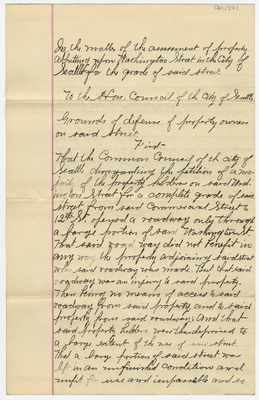

In the matter of the assessment of property abbutting upon Washington Street in the city of Seattle for the grade of said Street. To the Hon Council of the City of Seattle Grounds of defense of property owners on said sreet. FirstThat the Common Council of the City of Seattle disregarding the petition of a majority of the propoerty holders on said Washington Street for a complete grade of said Street from said Commercial Street to 12th St opened a roadway only through a large portion of said Washington St That said road way did not benefit in ayway the property adjoining said street when said roadway was made. But that said roadway from said property and to said property from said roadway: And that said property holders were thus deprived to as large extent of the use of said street. That a large portion of said street was left in an unfinished condition and unfit for use, and impassible and so

3

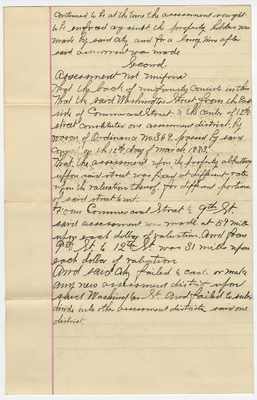

continued to be at the time the assessment sought to be enforced against the property holders made by said City and for a long time after said assessments were made. Second. Assessment not uniform. That the lack of uniformity consists in this That the said Washington Street to the Center of 12th Street consititues one assessment district: by reason of Ordinance No 369 passed by said Council on the 12th day of March 1883. That the assessment upon the property abbutting upon said street was fixed at different rates upon the valuation thereof for different portions of said street to wit: From Commercial Street to 9th St said assessment was made at 59 mills upon each dollar of valuation. And from 9th St to 12th St was 31 mills upon each dollar of valuation. And said city failed to create or make any new assessment district upon said Washington St and failed to subdivide into other assessment districts said one district.

4

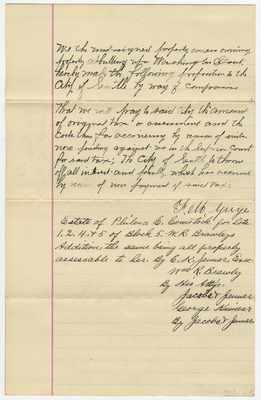

We the undersigned property owners owning property abutting upon Washington Street hereby make the following proposition to the City of Seattle by way of compromise. That we will pray to said city the amount of original tax or assessment and the costs thus far accruing by reason of writs now pending against us in the Superior Couts for said tax: the Cityof Seattle to throw off all interest and penalty which had accrued by reason of non payment of said tax: F M Guye Estate of Philena C Comstock for lots 1,2,4,&5 of Block 5, W R Brawleys Addition, the same being all properly assessable to her. By C K Jenner, Exec. Wm R Brawley By his Attys Jacobs & Jenner George Kinnear by Jacobs & Jenner