Pages That Mention block 11

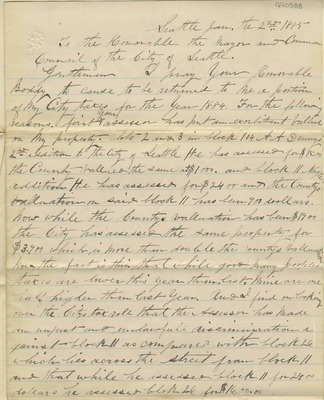

990388

1

Seattle Jan. the 2nd 1885 To the Honorable the Major and Common Council of the City of Seattle.

Gentlemen I pray your Honorable Boddy [sic] to cause to be returned to me a portion of my City taxes for the year 1884. For the following reasons. First your assessor has put an exorbitant vallue [sic] on my property, lots 2 and 3 in block 104 AA Dennys 2nd addition to the City of Seattle. He has assessed for $1500 the County valued the same at $1000. and block 11 Nagle addition He has assessed for $2400 and the County valluation [all sic] on said block 11 has been 900 dollars. Now while the County valluation has been $1900 the City has assessed the same property for $3.900 which is more than double the countys [sic] valluation. Now the fact is this, that while good many peoples [sic] taxes are lower this year than last, mine are one half higher than last year. And I find on looking over the Citys [sic] tax roll that the assessor has made an unjust and unlawful discrimination against block 11 as compared with block 26 which lies across the street from block 11 and that while he assessed block 11 for 2400 dollars he assessed block 26 for $1600.00

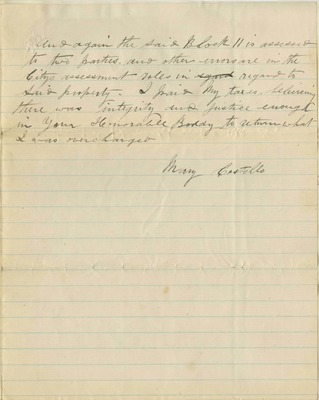

2

And again the said Block 11 is assessed to two parties, and other errors are in the Citys [sic] assessment roles in regard to said property. I paid my taxes believing there was integrity and justice enough in your Honorable Boddy [sic] to return what I was overcharged.